Imagine a world where insurance compliance is not a thing anymore.

A corporate office needs urgent repair and maintenance: The property management team googles an approved vendor and schedules the work order. Easy!

A construction company is pre-qualifying subcontractors: The project team receives bids and all insurance certificates are compliant in advance. Done!

Scheduling, approval, compliance – everything is instant. That way your managers, vendors, and supervisors all go about their day.

Back to reality – “instant” is not how things work today.

You need to verify insurance compliance for every project, property and transaction in the built world. And this process, well, sucks.

Your team keeps chasing certificates of insurance (COIs) day after day. They typically use email. Maybe they use a spreadsheet. Perhaps they use a COI tracker that does things a bit faster.

But still, projects and payments get delayed, approvals take weeks, and managers waste hundreds of hours juggling COIs.

Why Does The Process Suck?

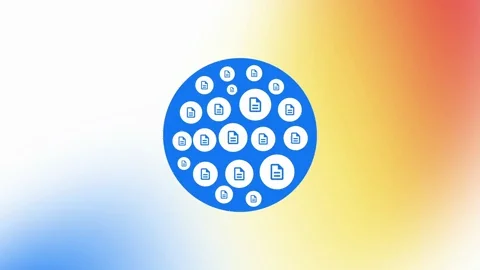

It all starts with a siloed manual workflow. Every building and construction site across the country runs their COI approvals locally for every tenant, vendor and/or subcontractor.

How the siloed insurance compliance process works

There is a good reason and a bad reason for this workflow.

The good reason is that each location has unique insurance requirements that are tied to the owner’s risk appetite. That’s logical.

The bad reason is that management teams are responsible for COI approvals, but in reality they are untrained in insurance, they make mistakes all the time, and they simply hate it (read: nobody got promoted for being a great COI manager).

This leaves a lot to be desired – vendors get denied entry, subs get denied payment, and projects get delayed for weeks.

Adding insult to injury, this process is repeated in different ways across millions of properties and construction sites every day. Yes, it’s that bad.

Why Should We Actually Fix It?

Before Jones, I struggled with insurance certificates for years as a sales manager in real estate. I despised the compliance process and started a company to fix it.

So, my co-founder and I came together to build software that made insurance compliance bearable for our clients.

We made approvals 2x faster, we made the user experience super simple, and we integrated the tool with major ERP systems such as Procore, MRI, Yardi and others.

But this only took us so far. Our software was a painkiller, not a total cure.

We never stopped thinking about how to fix what makes insurance compliance broken at the core – the local siloed approach.

But what if you had global access to the insurance profile of any tenant, vendor, and subcontractor at your fingertips?

What if you could predict anybody’s compliance rate in order to make smarter, quicker procurement decisions?

What if you could distribute insurance data to any stakeholder – tenant, owner, manager – all with a click of a button?

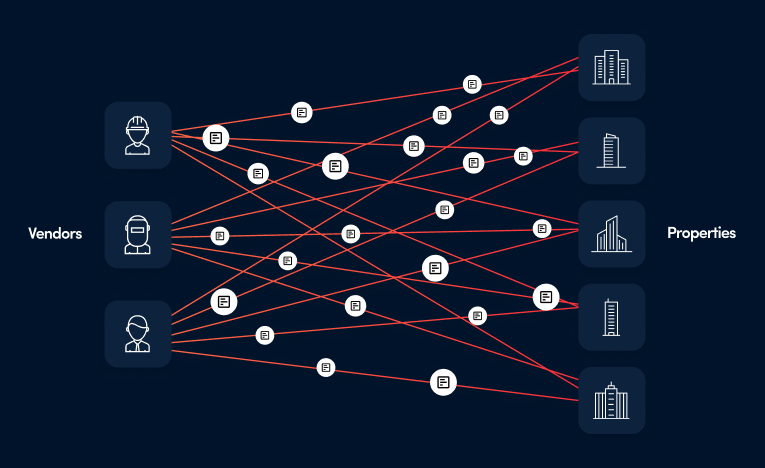

Imagine one system that aggregates all the world’s insurance data and distributes it across any transaction in the built world.

That’s what we’ve built. We call it The Jones Network.

What is The Jones Network?

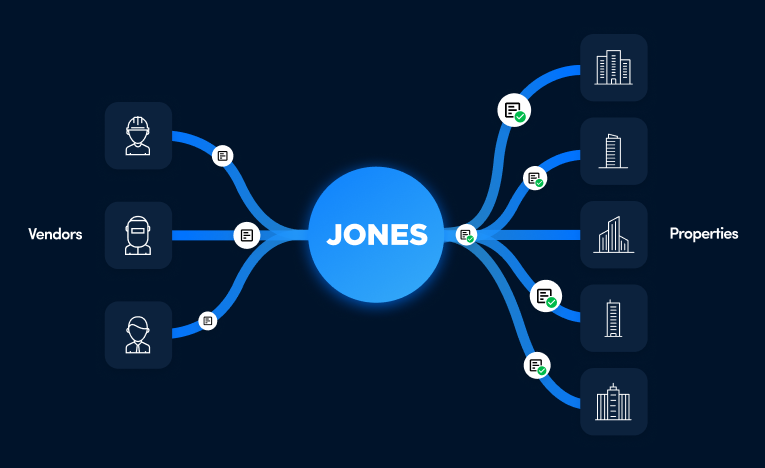

It is all the insurance coverage information you will ever need – collected, reviewed, and stored in one system to benefit everyone.

The Jones Network enables users to access relevant data that is sourced from across our ecosystem of buildings and construction sites that run on Jones every day. The more customers we add to our network, the better it gets for everyone.

We placed software applications at the center of the network, so that you can leverage the insurance data to run seamless compliance transactions – tenant leases, subcontractor pre-qualification, vendor procurement, payments – anything.

Think of it like a Linkedin for insurance compliance in the built world.

Sound awesome? It is! Here’s how it works:

- Leverage existing insurance data to end the collection nightmare

- Access dynamic contact information to source insurance documents directly (company, broker or agent)

- Standardize the resolution of insurance gaps with global requirements

- Optimize insurance requirements based on industry-wide benchmarks

How the centralized insurance compliance process works

Related: How to Look Up Insurance Coverage For Any Vendor Or Subcontractor On The Jones Network

How Does The Jones Network Get The Job Done?

The architect of disruptive innovation, Professor Clay Christensen, said that milkshakes are excellent products not because they taste good, but because consumers need a nourishing drink that sips slowly during their boring commute to work.

In other words, milkshakes get the job done far better than coffee, bananas, and others.

In a similar fashion, The Jones Network helps real estate managers get their jobs done more effectively than any other tool on the market.

The jobs-to-be-done:

- Skip the headache of collecting insurance certificates altogether

- Vet vendors and see how likely they are to be compliant before hiring them

- Give tenants control over compliance to improve their procurement decisions

- Hire vendors and subcontractors rapidly for urgent projects

- Improve time-to-hire by transacting with pre-approved vendors

- Reduce liability by using existing insurance profiles, documents and contact info

How Does The Jones Network Transform Your Business?

Proptech has made big promises to real estate for almost a decade. Now more than ever is the time to deliver.

The economic climate has brought about a paradigm shift. Insurance premiums are rising, tenants demand seamless experiences, and budgets have tightened dramatically.

As you examine what impact the insurance compliance process has on the bottom line, the conclusions are, oftentimes, very disappointing.

With the Jones Network, you can make better procurement decisions by having the intelligence in advance to know how likely your vendors and subcontractors will be compliant.

You can finally deliver on the demanding expectations of commercial tenants who need to get vendors approved ASAP. Even better, you can offer tenants a pre-approved vendor network that lets them skip the compliance process altogether.

In a world of rising premiums, The Jones Network will give you dependable, data-driven confidence that project and property managers are making error-free decisions that protect your company from claims.

If your employees spend thousands of hours on insurance compliance, The Jones Network allows you to reduce that unnecessary workload, saving countless hours and reallocating the team to truly high-value tasks.

In other words, it is time we held proptech to the same standard as that of the real estate and construction industries.

The Jones Network will cut operational costs by radically improving processes rather than just optimizing them, integrating with core systems and moving your organization towards data transparency.

We will of course still provide the same software you have come to expect to simplify and automate insurance compliance. Better yet, now the software is powered by a network of tens of thousands of vendors and their verified insurance data that is analyzed by AI and accessible to every stakeholder across your company.

It is the time to give the industry — and management teams that propel it forward — a compliance solution that actually makes sense!

Ready to learn more about The Jones Network?

Let’s Chat!