We compared three Trustlayer alternatives, looking for a COI tracker that was better than Trustlayer at:

-Collecting and reviewing subcontractor COIs and endorsements

-Providing actionable risk management data

-Syncing data with Procore and GC accounting systems like CMiC and Sage

-Allowing risk professionals to waive, send, or accept coverage gaps

We’ll dive into full summaries of these Trustlayer alternatives below, but here’s our TL;DR:

Quick Takeaways

-Jones brings together a high level of construction insurance expertise and a Procore integration that makes collecting and reviewing subcontractor insurance documents simpler than its competitors

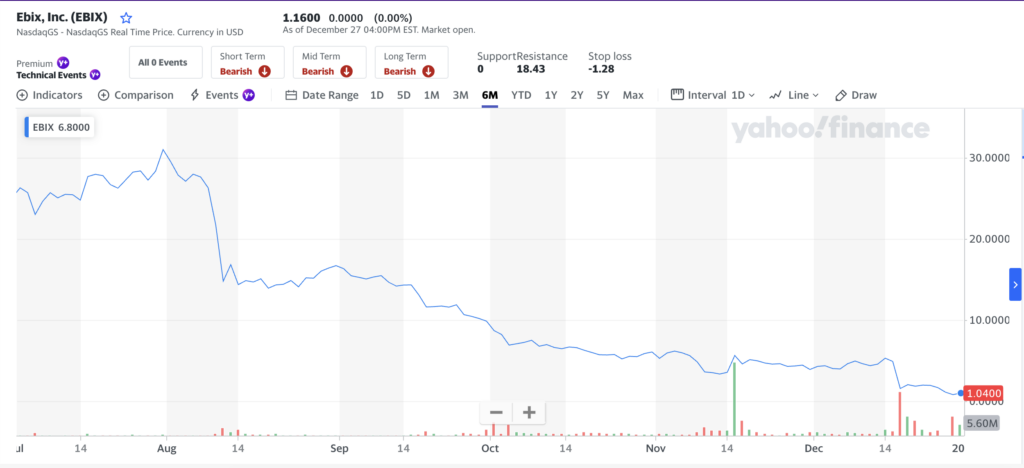

-Ebix recently declared bankruptcy, leaving the future of their COI tracking services in doubt

-myCOI serves a wide range of industries and is capable of tracking COI expiration dates

Table of Contents

-Trustlayer Alternatives #1: Jones

-Trustlayer Alternatives #2: Ebix

-Trustlayer Alternatives #3: myCOI

Overview of Trustlayer

Note: Jones manages the collection and review of subcontractor insurance documents to help GCs protect themselves from insurance risk. Want to learn more? Talk to our team of experts today!

What is Trustlayer?

Trustlayer is a software that helps GCs manage the collection and review of their subcontractor COIs and endorsements. Trustlayer reviews insurance documents with their OCR (optical character recognition) as well as offering the option of human document review for an additional fee. Trustlayer also notifies users about COI expiration dates and sends coverage gap emails to subs.

Who is Trustlayer For?

Trustlayer is suited for customers from a variety of industries, including government services, higher education, manufacturing, retail, and grocery stores. Their solution is industry-agnostic and fits the general needs of a diverse set of sectors.

Strengths of Trustlayer

Trustlayer has received some positive reviews from existing customers. Here’s what they highlighted as strengths of the platform.

Automates COI Collection

Customers have reported that having Trustlayer handle the collection of their COIs has freed up time for risk teams. Reviews indicate that subcontractors are receptive to dealing with Trustlayer to submit insurance documents.

Strong Customer Support

Multiple reviews highlighted the supportive and helpful nature of the Trustlayer support team. When users run into issues with the product the Trustlayer customer support team has been quick to try and find workarounds.

Weaknesses of Trustlayer

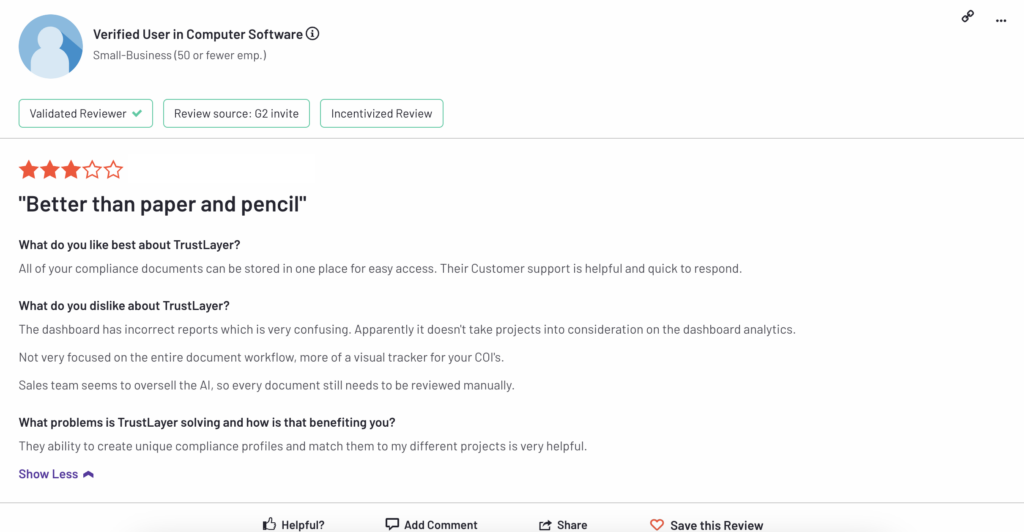

Trustlayer does have some serious shortcomings, particularly in regard to the quality of their OCR technology and pricing model. Here’s what customers have cited as weaknesses of Trustlayer.

OCR Document Reading Technology Makes Mistakes

Former Trustlayer customers have reported that the quality of their document review can be lacking for organizations with complex requirements. One former Trustlayer customer mentioned that Trustlayer frequently asked vendors for requirements they did not mandate. They said it takes “far more effort than necessary to get vendors compliant” for their team. In addition, former customers reported that Trustlayer’s OCR (Optical Character Recognition) technology was prone to making errors.

Human Document Review Not Included in Base Pricing

Trustlayer requires customers to pay extra to have human insurance experts review their documents. If you don’t want to pay for their “TrustLayer+ with Outsourced Risk Management” package you only get a basic COI expiration tracker and OCR document review capabilities. One former Trustlayer customer felt that Trustlayer oversold the capabilities of OCR and tried to upsell them when they realized it wasn’t enough to mitigate insurance risk.

Reporting Options Are Not Customizable

Several former Trustlayer customers cited Trustlayer’s lack of reporting and visualization capabilities as a major pain point. One company told us they would rather sync their Trustlayer data into Power BI than try to use Trustlayer’s native dashboards. Another former Trustlayer customer told us they had “no reporting capabilities to help [them] figure out why vendors aren’t compliant without drilling down into every interaction they had with Trustlayer.”

Tries to Upsell Insurance Products to Subcontractors

It’s potentially a conflict of interest to try to both enforce compliance and profit off of missing coverages. Former Trustlayer customers have reported that Trustlayer does just this, trying to sell gap insurance to subcontractors. Some GCs are okay with this, but others we’ve spoken to are worried about a software provider trying to turn a profit from their subcontractor base.

Key Takeaways About Trustlayer

Trustlayer has its strengths, but also has weaknesses that should give any organization looking to onboard them pause. Whether it’s attempting to profit off your subcontractor relationships, substandard automated document review, or the fact human document review costs extra, we would recommend looking elsewhere.

With that in mind, here are three Trustlayer alternatives to look into.

Trustlayer Alternatives #1: Jones

Jones is an insurance compliance solution that helps construction companies reduce insurance risk on all their projects. With a high level of construction-specific insurance expertise, an embedded Procore integration (read more here), and customizable reports, Jones gives risk teams powerful tools to mitigate insurance risk.

Strengths of Jones

Construction-Specific Insurance Expertise

Jones supports complicated risk management processes for ENR 400 GCs like Harvey-Cleary and Manhattan Construction with construction-specific insurance knowledge and workflows. For example, Jones is designed to make it easy for GC risk teams to loop in their insurance brokers for full policy reviews. Jones can also customize waiver approval processes, escalations, and document review standards to fit the needs of different GCs.

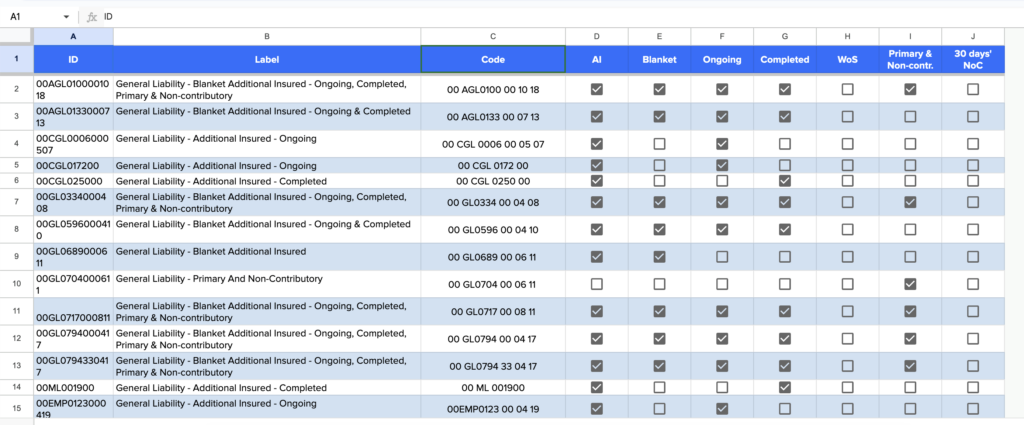

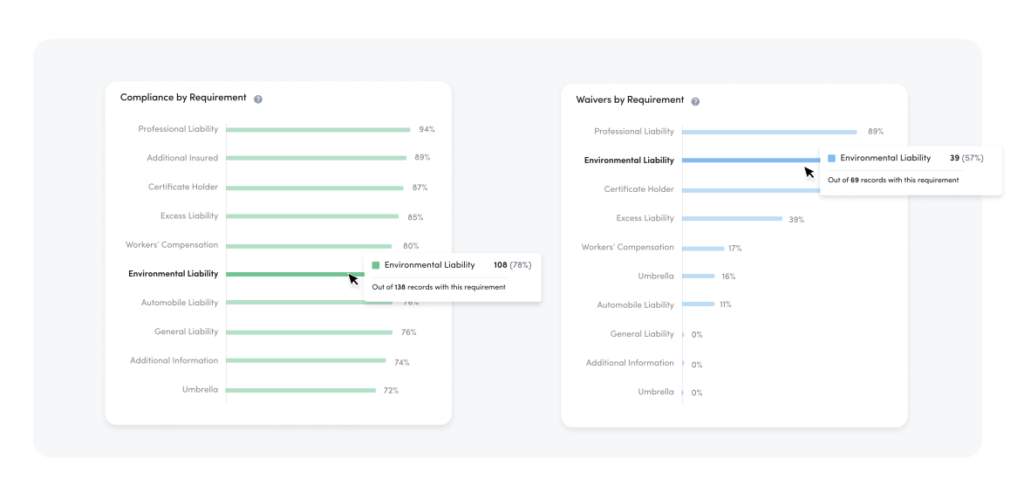

The Jones team maintains an up-to-date endorsement index with over 1800 construction-specific endorsements that makes it easy to quickly check whether endorsements confer Ongoing and Completed coverage, Primary and Noncontributory coverage, Waivers of Subrogation, and more. In addition, the Jones team is familiar with reviewing COIs containing tricky Workers’ Compensation concepts like monopolistic states, Stop Gap coverage for Employer’s Liability, and continuous coverage in Washington State.

Jones is familiar with the complexity of Additional Insured language for construction. While contractual privity language can be a useful way to transfer risk to companies named in a contract, certain GCs either require Blanket Additional Insured endorsements or named Additional Insured status for certain project owners to confer coverage based on owner agreements. This CG 72 46 11 15 endorsement the Jones team recently reviewed for a customer is a perfect example of a case where contractual privity language in the first point wouldn’t suffice to confer AI coverage to an owner, but the second point would.

Jones can tailor what endorsements and language are accepted to confer AI status to the risk appetite of each GC, as well as whether checkboxes or language in the Description of Operations is sufficient. The Jones team also knows when the Description of Operations box cannot be used to confer AI status due to state specific regulations in Georgia, Texas, and Oregon.

Speed of Document Review

Jones maintains a sub-24 hour insurance document review time for all customers. Whether it’s a quiet period or the middle of renewal season, the Jones team commits to turning COI and endorsement reviews around in under 24 working hours.

Procore Integration Helps Expedite Payments and Boosts Collection Rates

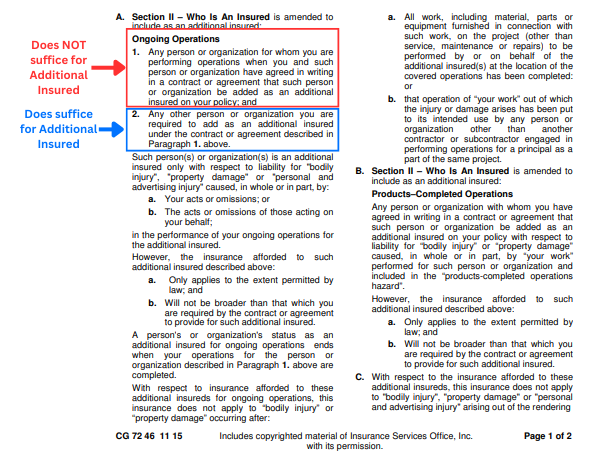

Jones is the only compliance management solution with an embedded Procore integration. That means users don’t need to constantly switch between Procore and Jones in order to perform insurance compliance tasks like requesting COIs from a sub.

Risk teams can proactively manage subcontractor insurance compliance with the Jones Procore integration. Risk managers we’ve spoken to have highlighted the importance of collecting subcontractor insurance docs as soon as a subcontract is signed. For customers who use both Procore Financials and Jones this is simple, as the Jones Procore integration notifies risk teams when a sub is added to a commitment without insurance documentation. The Jones Procore integration groups all these subs together so your risk team can prioritize collecting outstanding documentation to get projects moving faster.

The Jones Procore integration also helps accounting teams expedite AP and minimize communications with subcontractor insurance brokers by making it easy to manage global-level insurance requirements. Accounting teams can easily sort their global subcontractors from their project-specific ones in Procore when issuing payments, and cut down on duplicate insurance documents floating around their systems. Find out more about how the Jones Procore integration makes life easier for accounting teams with Global Insurance Requirements here.

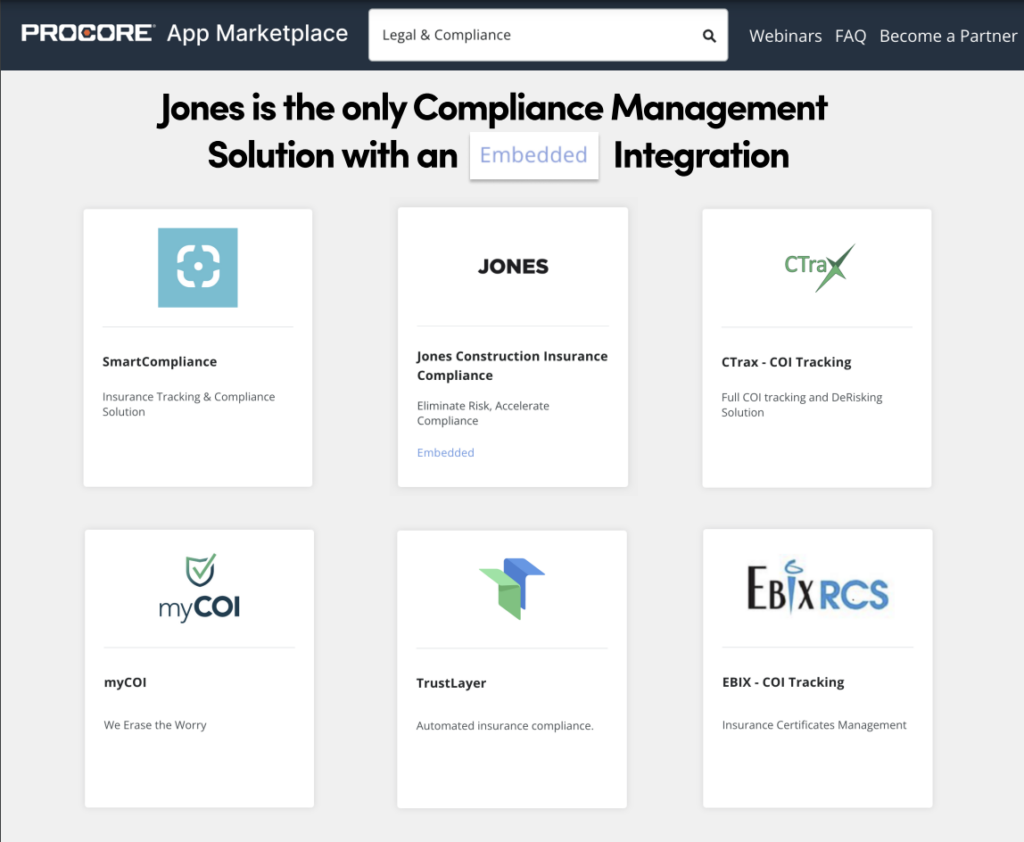

Reporting Features Make Acting on Compliance Issues Easy

Jones makes it easier to identify and act on compliance issues with a wide variety of reporting options. For example, Jones makes it easy for accounting teams to prioritize chasing the right COI renewals by giving them the option to sort subcontractor COIs based on expiration dates. Or, risk teams can examine the consistency of their waiver process on a project by project basis with our “Waivers by Requirement” chart to see if any of their teams are applying waivers too liberally. Sorting based on “Compliance by Requirement” could help highlight requirements with unrealistically high limits or coverages. Analyzing and enforcing your subcontractor insurance risk strategy is easier with insights from Jones.

Weaknesses of Jones

Serves a Limited Set of Industries

Unlike Trustlayer, Jones only serves two industries: construction and commercial real estate. That means brands in industries like trucking, higher education, or manufacturing will have to look elsewhere for COI management services. Jones has chosen to focus specifically on designing a COI management solution built for the unique needs and risk profiles of construction and CRE.

Initial Low Compliance

Customers switching to Jones from either manually managing their own COIs or another platform might be surprised to see how low their initial compliance numbers are. This is largely because a lot of organizations either don’t have visibility into their compliance or require more coverage than is actually relevant. The Jones team can help design better requirement sets by providing risk data from 14,000+ projects and properties across the US that are on Jones.

Trustlayer Alternatives Key Takeaways: Jones

Jones brings a combination of insurance risk expertise and a powerful COI management platform to the table. GCs and CRE companies looking through Trustlayer alternatives for a new solution need look no further than Jones.

Trustlayer Alternatives #2: Ebix (Recently Declared Bankruptcy)

Ebix offers a range of software solutions, including COI tracking. There are undoubtedly some organizations that are happy with Ebix, but the fact they recently declared bankruptcy should make anyone who is browsing Trustlayer alternatives think again, and should motivate existing customers to look elsewhere.

Strengths of Ebix

Well Established Company

Ebix has been around for almost 50 years, and in that time has accumulated a large number of customers. Ebix has proven its ability to handle large amounts of documentation in its system.

Publicly Traded

Ebix is a publicly traded company on the NASDAQ stock exchange. Its status as a public company is sure to inspire confidence in some potential customers.

Weaknesses of Ebix

Recently Declared Bankruptcy

Ebix recently filed for bankruptcy and defaulted on $617 million in loans. As a result, some of their assets are being sold at auction to cover the costs of the loans. This poses a massive risk to any Ebix customer, as it’s unclear what the future of the company looks like and whether or not they’ll still be solvent to handle customer COIs. Read more about Ebix’s chapter 11 bankruptcy filing here.

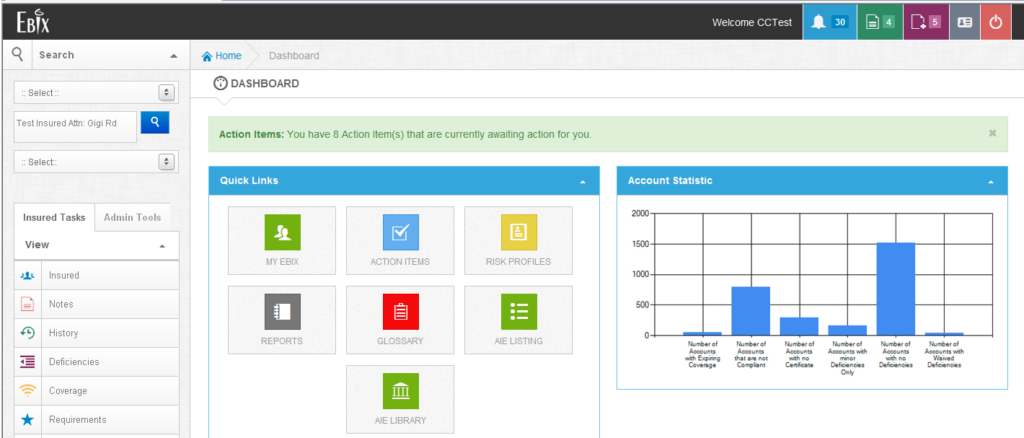

Cumbersome and Dated Dashboards

Former customers have reported that Ebix’s dashboards are antiquated and hard to use, making it difficult to identify gaps in their insurance risk strategy. They also shared that the reporting options in Ebix’s solution haven’t changed much if at all over the course of the past few years. In light of their bankruptcy, don’t expect to see new product updates any time soon.

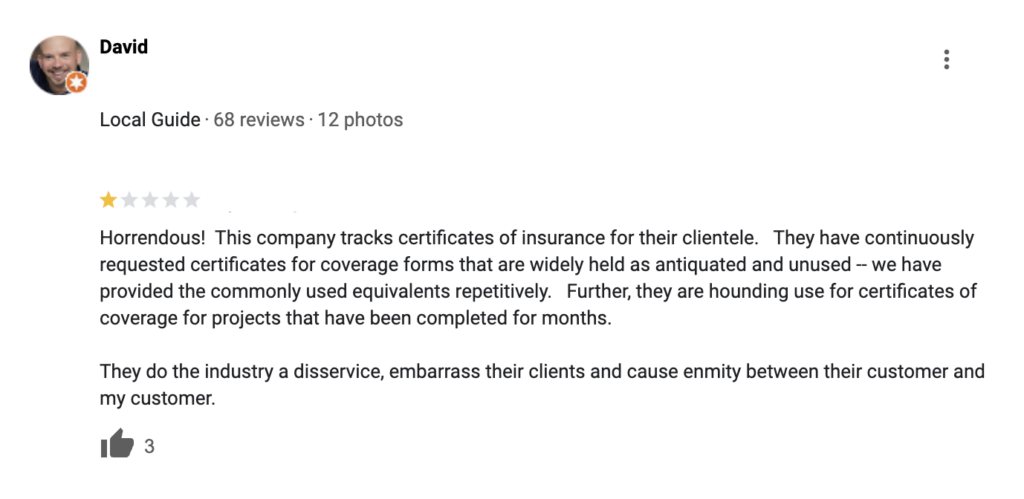

Emails Look Like Spam

Ebix sends emails with PDF attachments detailing insurance gaps to vendors and subcontractors. Many of these emails are redirected to spam folders. The reluctance of vendors and subcontractors to open PDFs can lead to a decrease in COI collection rates.

Slow Document Review Times

Former Ebix customers have reported slow document review times being a major problem. We’ve heard reports of COIs and endorsements taking a week or more to be reviewed, with that time stretching even longer during busy periods.

Trustlayer Alternatives Key Takeaways: Ebix

Ebix is a legacy software provider with years of COI management experience that is currently experiencing a period of upheaval due to bankruptcy. Whether or not the company continues to exist in its current state is unclear, leaving the future of their COI management program murky.

Trustlayer Alternatives #3: myCOI

myCOI is a cloud-based COI tracker that serves a wide variety of different industries. They’ve been reviewing insurance documents for 15 years, and operate on a four-day workweek schedule.

Strengths of Trustlayer

Serves a Wide Range of Industries

myCOI handles COIs for brands in sectors including education, aviation, cannabis sales, and more. If you’re a brand in an industry that isn’t served by Jones, Ebix, or Trustlayer, you might want to consider myCOI.

15 Years in Business

myCOI has been handling customer COIs for 15 years. Their longevity inspires confidence that the brand will still be around over the course of the next few years.

Weaknesses of myCOI

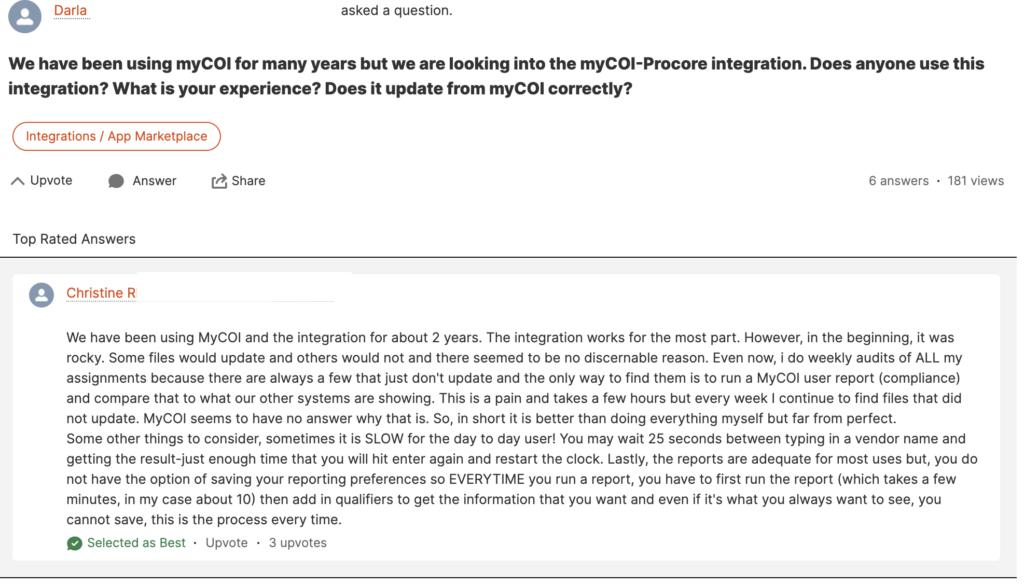

Limited Procore Integration

Unlike Jones, myCOI’s Procore integration is only one way. That means it’s not capable of both pulling data from and pushing data to Procore. Opting to use myCOI alongside Procore means you’ll have to do more manual data entry than with an embedded compliance management solution. In addition, myCOI users have reported bugs with their Procore integration on the Procore forums.

Slow Document Review

Customers report that myCOI’s document review time varies from days to weeks. Multiple former customers note that myCOI blames “unprecedented growth” for delays in subcontractor COI and endorsement reviews. With this growth, adding more customers is likely to further extend myCOI’s review times.

Complicated Document Upload Process Frustrates Subcontractors

A COI management software should make it as easy as possible for subcontractors, vendors, and tenants to submit their insurance documents. myCOI makes the process difficult by requiring third parties to create an account with a username and password to upload their COIs and endorsements. For less tech-savvy vendors, tenants, and subs, this can be a large obstacle to collection. In addition, their communication of gaps to third parties is unintuitive, as reviews have shown.

Trustlayer Alternatives Key Takeaways: myCOI

myCOI is a legacy brand that has outlasted a variety of its competitors in the COI management space. Their wide set of industries served makes them a solid option for brands in niche sectors, but when it comes to CRE and construction their slow document review times and complicated upload flow doesn’t always fit the needs of these fast moving and high risk industries.

Trustlayer Alternatives Final Verdict

Looking to pick between the Trustlayer alternatives we’ve gone over?

Choose Jones if the most important criteria for you include:

- Expertise with construction risk

- Procore integration functionality

- Variety of reporting options

Choose myCOI if:

- You are only looking for a no-frills COI tracking platform

- You are in one of the niche industries myCOI serves

- You don’t use Procore

We would not recommend Ebix in light of their recent bankruptcy declaration.

What is an Embedded Integration?

An embedded integration both sends data to and receives data from Procore, and appears directly within the Procore app. Put simply, that means the two software communicate back and forth, and users don’t need to switch between Procore and Jones in order to perform COI management tasks. For example, the Jones Procore integration allows you to request a COI from a subcontractor directly in Procore rather than from the Jones app.